Trains in transition

China doesn’t think small, but big. In the case of rail transportation, thinking big refers to a high-speed railroad network traversing the country over a 35,000-kilometer (22,000-mile) distance – a project that was put on a fast track as well. Planning began in 2004 and the first high-speed trains hit the tracks in 2008. In 2020, China is ranked in the top spot worldwide and planning to lay an additional 13,000 kilometers (8,000 miles) of tracks by 2035. These are dizzying statistics and dimensions even when just reading about them.

Obviously, a territorial state like China is hardly comparable to the European union of countries, both politically and geographically. The financial dimensions are different as well: The Middle Kingdom invests enormous amounts of money in the expansion of its China State Railway Group (in short: CR). CR has a debt of 650 billion euros. Greece’s national debt is only half as high. For Transport Minister Li Xiaopeng, such numbers are no reason for hitting the brakes, because the transportation infrastructure drives economic growth and provides the basis for a more comfortable society, he says.

For Schaeffler’s Industrial Division, the Chinese railroad market is a growth engine as well. In August, the Group signed a cooperation agreement with the China Academy of Railway Sciences (CARS). Through this cooperation Schaeffler plans to adapt its rail products more precisely to the Chinese market and grow its market share. The agreement includes the establishment of a joint venture between Schaeffler and CARS for the development of railroad bearings, the reconditioning and assembly or axle box bearings, and the development and production of condition monitoring systems for bogies.

Even at this juncture, the outcome of the arms race on rails makes European long-distance train travelers look toward China with envy. The Fuxing super-train travels the 1,200-kilometer (750-mile) distance between China’s capital Beijing and the business metropolis Shanghai in just under four hours. An important “sound barrier,” because various surveys of travelers have shown that trains can particularly score in comparison to airliners when travel time is less than four hours.

Train travel is faster than flying

The motherland of the high-speed train idea is China’s neighbor Japan. The island state started the speed arms race on rails back in 1964: Right in time for the opening of the Olympic Summer Games in Tokyo, the first Shinkansen train zipped down the tracks to Osaka. In the following nearly 60 years, the high-speed train system has been perfected step by step. Innovation boosts in braking and tilting technologies have caused the speedometer needle to continuously rise. Accordingly, the travel time for the 500-kilometer (310-mile) distance has dropped from the original four hours to currently 2:22 hours. Rail engineers are now aiming for two hours.

The Shinkansen network already outperforms air travel on many routes today: due to fast connections, low headways, favorable fares, and extremely high punctuality and reliability. The major Japanese railroad company JR-East says the average delay is 50 seconds. This number would be close to zero without the delays caused by natural disasters like earthquakes and typhoons, which are not uncommon in Japan.

Europe is high-speed-capable, too

Spearheaded by Germany (ICE), France (TGV) and Spain (AVE), Europe is sending a number of high-speed heavyweights into the race as well. As far back as 30 years ago, the ICE broke the 400 km/h (249 mph) record. However, the train is struggling with the problem of an insufficient number of routes on which to fully exploit its speed potential. One of the reasons for this is that, when the ICE project was launched, Deutsche Bahn chose to minimize the distances between the places where its passengers live and the nearest ICE train stations. Consequently, there’s a large number of stops and even if an ICE doesn’t stop in a particular city, it has to reduce speed while traveling through it.

By contrast, the French TGV preferably travels the country at full speed. Its tracks were laid in ways that circumvent the cities at which it doesn’t stop. This accelerates the pace but makes boarding more difficult. There are good reasons for both strategies. The advantages of the TGV can be read on a clock. The fast French train travels the 765-kilometer (475-mile) distance from Paris to Marseille nonstop in a little more than three hours. It takes the ICE a minimum of 5:35 hours, and usually even an hour longer, to cover nearly the same distance from Hamburg to Munich (780 kilometers/485 miles) with half a dozen stops in between. As a result, it clearly surpasses the four-hour mark and has a hard time competing with the temptations of air travel. The situation is different on the newly built high-speed track between Berlin and Munich. It takes the ICE just under four hours to cover the 623 kilometers (387 miles). Although that’s 1.5 hours longer than it takes the Spanish AVE to travel the 621 kilometers (386 miles) between Madrid and Barcelona, the time still has the magic four as a prefix. This pays off: According to Deutsche Bahn, in 2018, its first year of service, this new connection motivated more than one million travelers to switch from cars and 1.2 million from airliners to trains, making this means of transportation the most popular one on this particular route. Even the time-consuming stop in Nuremberg has paid off: Eurowings canceled its service from Nuremberg to Berlin – the train had wooed too many passengers away from the airline.

Digital coupling

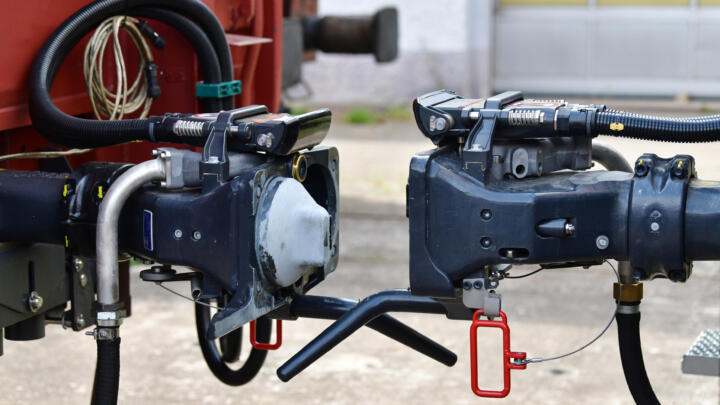

It’s hard to believe, but true: On cargo trains and those with classic cars, European railroad operators are still unanimously using the screw couplings introduced in 1861 (top picture) that are manually connected by workers. Subsequently, the rows of cars have to be entered on lists – of course, manually as well. This is to change – with an automated digital coupling (bottom picture).

The “Allianz pro Schiene” (“Pro-Rail Alliance”) association welcomes this initiative by the German federal ministry of transportation. “The Digital Automatic Coupling” can provide the long hoped-for boost to climate-friendly rail transportation in Europe,” says Managing Director Dirk Flege. The Europe-wide system change that’s projected to take several years targets 2030 for completion. The forecast costs amount to some ten billion euros to be shared by governments and railroad operators.

Germany is planning to make train travel more attractive with yet another signature project: the revival of the Trans-Europe Express (TEE) that was discontinued in 1987. “Such a TEE network for high-speed and night trains can be accomplished by 2025. We need to get started now,” says Germany’s Minister of Transportation Andreas Scheuer, verbally accelerating the pace. Now actions must follow, because the need for innovations for a TEE 2.0 is as high as the need for capital expenditures. Electric power and train control systems, as well as distribution and fare systems, vary across the EU, not to mention the lack of high-speed tracks, especially in the eastern and south-eastern regions of the continent. Other key infrastructural projects such as the underground train station billed as Stuttgart 21, the Fehmarn Belt Fixed Link including a back-country train connection linking Germany with Scandinavia, and the Brenner Base Tunnel that’s important for south-bound traffic are still pending completion – and devouring billions of euros.

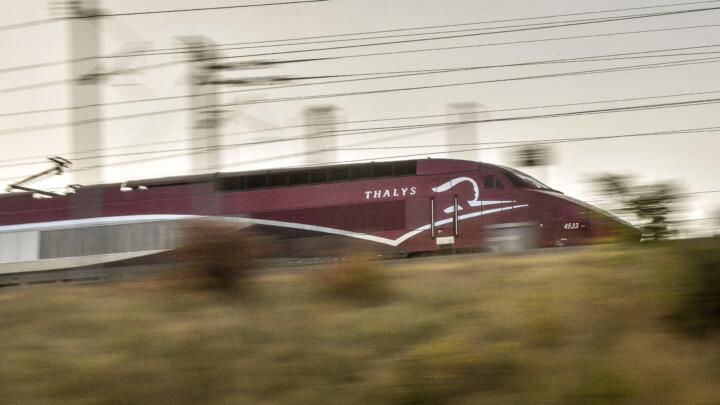

The Thalys train between Paris and Brussels, the Eurostar that chases in 2:14 hours from Paris to London, and the increasingly converging high-speed network of the neighboring countries Spain and France are bilateral examples that already work. Lines for longer distances such as Paris–Warsaw and Amsterdam–Rome could be implemented within a short period of time and make convenient inter-urban travel without changing trains possible. By contrast, other connections, like Stockholm–Munich and Paris–Budapest, call for major infrastructural upgrades. But even when the main routes are in place, all systems are running smoothly and average speeds of more than 200 km/h (124 mph) are achieved: transcontinental train travel across several international borders will remain a time-consuming – and costly – proposition. That’s why critics put a damper on the expectations pinned on a resurrected TEE. In the price war with the civil aviation sector and its low tax burden, non-subsidized long-distance train connections would hardly stand a chance, says, for instance, Walter von Andrian, editor-in-chief of the special-interest magazine “Eisenbahn Revue.”

Hydrail

is the generic term for trains using hydrogen as the energy source for propulsion. Manufacturer Alstom commissioned the world’s first “H-Train” in 2018. Its competitor Siemens (pictured) is planning to follow suit in 2024. In the long run, hydrogen locomotives are supposed to replace diesel units.

The deterring time factor on long-distance routes of more than eight hours of travel time could be mitigated by the deployment of night trains. Austrian ÖBB and Swiss SBB have already presented plans for establishing a Europe-wide night train network. This is another project that will require massive subsidies. The TEE is a project requiring a willingness to afford it, just like China affords its attractive, albeit uneconomical high-speed network. At the moment, two thirds of the 18 CR routes are losing money.

Airlines are heading for the tracks

That trains are becoming increasingly indispensable as a means of mass transportation in view of climate change has also dawned on airlines. In February, IATA, the International Air Transportation Association, and UIC, the International Union of Railways, decided to develop standards for simplifying the links between air and train travel. “We will develop a product to fly to London and take the train back,” says KLM executive Boet Kreiken, naming an example in the special-interest magazine “Aero Telegraph,” adding that “I think in the long term, short distances will be covered by trains.”

Maybe they’ll be hyperloop pods. These high-speed trains are supposed to chase through vacuum tubes at jet speed of up to 1,000 km/h (621 mph). The first crewed tests have begun, but critics of the technology remain skeptical. China and Japan, on the other hand, are pushing the magnetic levitation train system, an innovation that was born in Germany. The JR-Maglev is planned to connect Japan’s capital Tokyo with Nagoya starting in 2027. At an average speed of far above 500 km/h (311 mph), it will take the train 40 minutes to cover the 286-kilometer (178-mile) distance. The extension of the route to Osaka is planned to be completed by 2037, with a target travel time of 67 minutes – half as much as the current Shinkansen. Bon voyage!

3 questions for ...

Dr. Michael Holzapfel, Senior Vice President Business Unit Rail at Schaeffler

What major technical challenges will railroad operators be facing?

Rail traffic will considerably increase. In Germany, for instance, policy makers are targeting a 100-percent increase in passenger and a 25-percent increase in cargo transportation. It’s expected that there will be no proportional growth in the number of rail vehicles, so the existing trains will have to be used more intensively and longer. Propulsive power will increase as well in order to achieve lower headways and higher loading capacities. For us as a component manufacturer, this means that we have to offer products delivering even longer service life, allowing for more intensive operation, with even longer maintenance intervals, plus featuring more compact designs than before because more space for passengers or cargo is desired. In view of this requirements profile, a rolling bearing quickly turns into a high-tech product.

Rolling bearings will continue to exist for as long as trains run on rails

Dr. Michael Holzapfel

How is Schaeffler planning to meet these growing requirements?

We intend to continue driving developments with our know-know in materials, forming and surface finishing technologies even in areas where we already have a competitive advantage. Here’s an example: For iron-ore trains in Australia, we deliver rolling bearings enabling an axle load of 45 to 50 metric tons (50 to 55 short tons). This is twice as much as is currently required in Europe. But such dimensions are important in Australia as a prerequisite for cost-efficient operation of the trains.

Schaeffler is increasingly emphasizing mechatronic and digital product offerings – because you feel that the end of the rolling bearing is in sight?

No, not at all. Products like our condition monitoring solutions and the axle box generator are value-adding offerings for our customers, which they favorably respond to. But rolling bearings will continue to exist for as long as trains run on rails. Even a Hyperloop train creates contact for tracking in its vacuum tube and therefore requires rolling bearings.